Business Insurance in and around Columbus

Looking for insurance for your business? Search no further than State Farm agent Suzanne Rizer!

Helping insure small businesses since 1935

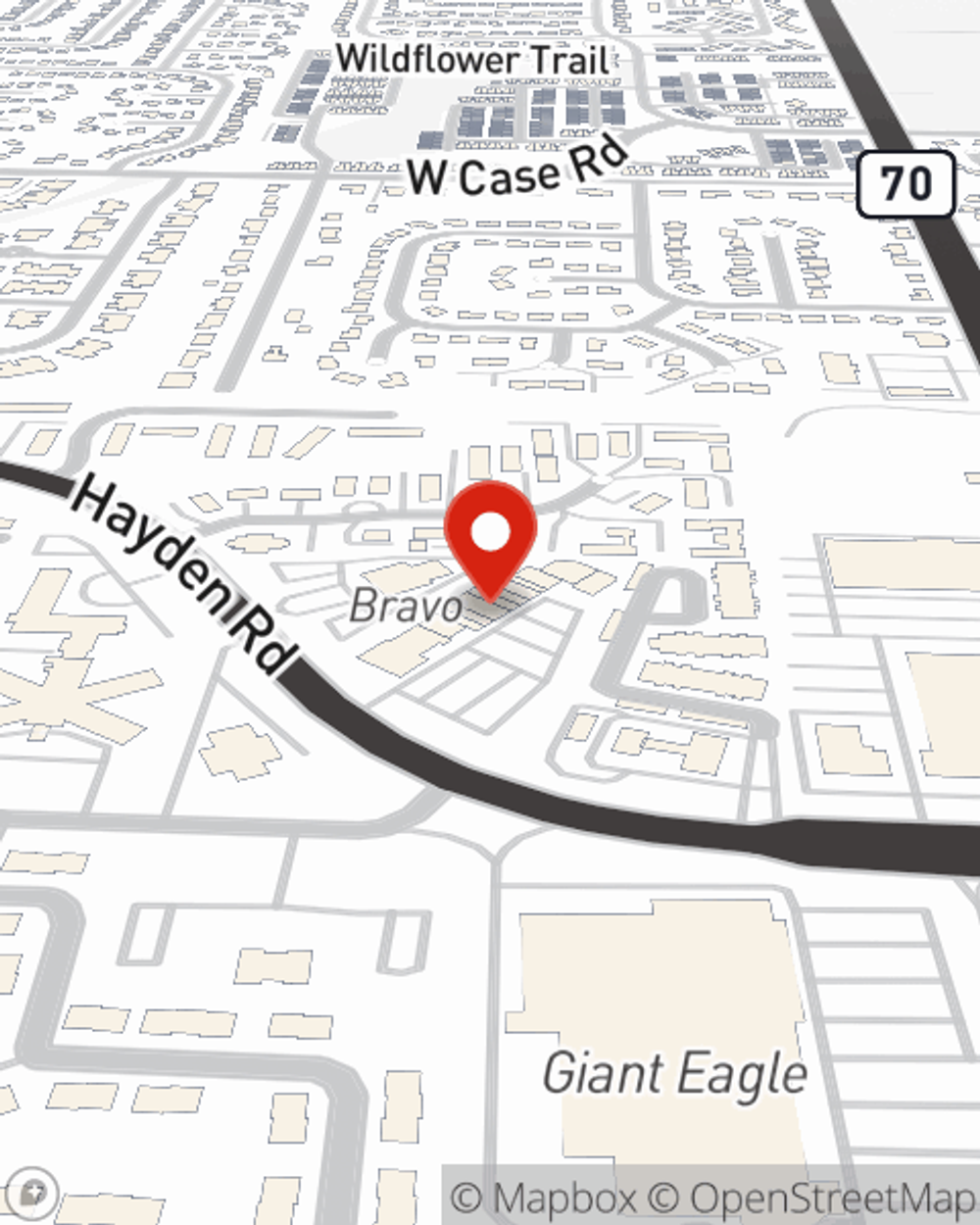

- Columbus, OH

- Dublin, OH

- Hilliard, OH

- Upper Arlington, OH

- Worthington, OH

- Powell, OH

- Westerville, OH

- New Albany, OH

- Franklin County, OH

- Delaware County, OH

- Ohio, US

- 43220

- 43221

- 43235

- 43017

- 43016

- 43026

State Farm Understands Small Businesses.

When you're a business owner, there's so much to take into account. It's understandable. State Farm agent Suzanne Rizer is a business owner, too. Let Suzanne Rizer help you make sure that your business is properly covered. You won't regret it!

Looking for insurance for your business? Search no further than State Farm agent Suzanne Rizer!

Helping insure small businesses since 1935

Protect Your Business With State Farm

If you're looking for a business policy that can help cover loss of income, business property, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Get in touch with State Farm agent Suzanne Rizer today to experience how a State Farm small business policy can ease your business worries here in Columbus, OH.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Suzanne Rizer

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.